Understanding the Basics of Business Profit Margin Calculation

In the competitive landscape of supply chain and logistics, understanding profit margins is not just helpful—it’s essential for survival and growth. Profit margin calculations provide critical insights into a business’s financial health by measuring the percentage of sales that exceed the cost of goods sold. This fundamental metric helps warehouse managers, logistics coordinators, and supply chain executives determine whether their operations are financially sustainable or require strategic adjustments. Without a clear understanding of profit margins, businesses may find themselves generating impressive revenue figures while actually losing money on each transaction.

The financial vocabulary surrounding profit margins can initially seem complex, but mastering these terms is crucial for accurate analysis. Gross margin represents the percentage of revenue that exceeds the cost of goods sold, essentially measuring the efficiency of production or service delivery. Profit margin, often referring to net profit margin, takes this calculation further by accounting for all business expenses, not just direct costs. Markup, meanwhile, refers to the percentage added to the cost of a product to determine its selling price. These distinct but related concepts form the foundation of financial analysis in warehouse and logistics operations, where even small percentage improvements can translate to significant dollar amounts given the high-volume nature of the industry.

For supply chain professionals managing multiple product lines or service offerings, understanding these metrics enables effective comparison between different segments of the business. A warehouse might operate with different profit margins for various product categories, and calculating these accurately helps in resource allocation and strategic planning. Additionally, these calculations serve as early warning indicators for potential issues, such as rising costs or pricing pressures, allowing management to respond proactively rather than reactively to financial challenges.

Moreover, profit margin calculations facilitate meaningful benchmarking against industry standards and competitors. A logistics company might have what seems like a reasonable profit margin in isolation, but when compared to industry averages, it might reveal opportunities for improvement or highlight competitive advantages. This comparative analysis helps businesses set realistic financial goals and develop strategies to achieve them, whether through operational efficiencies, pricing adjustments, or service differentiation in the marketplace.

How to Use a Margin Calculator Effectively

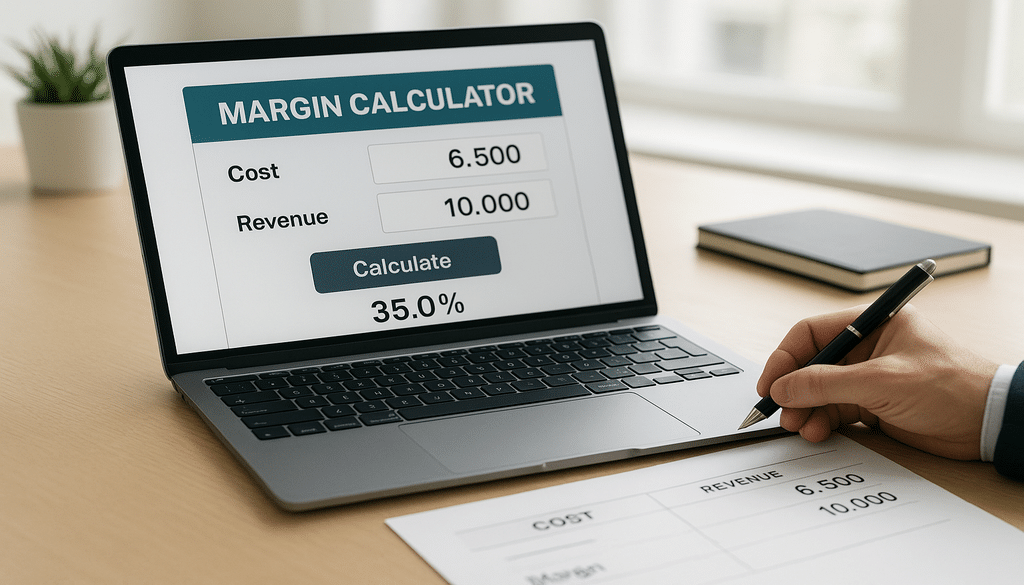

Leveraging a profit margin calculator transforms complex financial calculations into straightforward processes that save time and reduce the risk of mathematical errors. To begin using a margin calculator effectively, gather accurate data regarding your cost of goods sold (COGS), which includes direct costs associated with producing or acquiring the products you sell, such as raw materials, inventory purchases, and direct labor. Next, compile your sales revenue figures for the same period you’re analyzing costs. With these two primary inputs, a margin calculator can quickly determine your gross profit (sales revenue minus COGS) and subsequently calculate both your gross margin percentage and markup percentage, providing instant visibility into your financial performance.

When inputting data into a margin calculator, precision matters significantly—even small inaccuracies can lead to misleading results that might inform poor business decisions. Ensure that your COGS figures include all relevant direct expenses while excluding indirect costs like overhead, which are accounted for in different profitability metrics. Similarly, verify that your revenue figures represent actual sales rather than projected or invoiced amounts that haven’t been realized. Many supply chain businesses find it helpful to use data directly from their inventory management or accounting systems rather than manual calculations to minimize transcription errors and ensure consistency in how costs are categorized and calculated.

The true power of a margin calculator emerges when used as part of a regular financial analysis routine rather than as an occasional tool. Consider implementing weekly or monthly margin calculations for different product categories, customer segments, or distribution channels to identify trends and variations that might not be apparent when looking at aggregate business performance. For warehouse operations, this granular approach might reveal that certain product lines consistently underperform in terms of profitability, despite strong sales volumes, signaling a need for pricing adjustments or cost management strategies.

Advanced users of margin calculators often perform sensitivity analyses to understand how potential changes might impact their bottom line. By adjusting inputs such as cost increases, price changes, or volume fluctuations, supply chain managers can model different scenarios before making actual business decisions. For instance, a logistics company considering a price increase could use a margin calculator to determine the exact percentage needed to achieve target profitability, then assess how that increase might affect customer retention based on historical data or market research. This proactive approach to margin management transforms the calculator from a reporting tool into a strategic planning asset that supports informed decision-making across the organization.

Gross Margin vs. Markup: Clarifying the Differences

While often used interchangeably in casual business conversations, gross margin and markup represent fundamentally different financial concepts that serve distinct purposes in supply chain and logistics financial analysis.

-

Gross Margin is calculated by dividing gross profit (Revenue – Cost of Goods Sold) by Revenue, then expressing the result as a percentage.

Gross Margin (%)=Revenue – COGSRevenue×100\text{Gross Margin (\%)} = \frac{\text{Revenue – COGS}}{\text{Revenue}} \times 100Gross Margin (%)=RevenueRevenue – COGS×100

This shows what portion of each sales dollar remains after covering the direct costs of the product or service.

-

Markup is calculated by dividing gross profit by Cost of Goods Sold (COGS) and expressing it as a percentage.

Markup (%)=Revenue – COGSCOGS×100\text{Markup (\%)} = \frac{\text{Revenue – COGS}}{\text{COGS}} \times 100Markup (%)=COGSRevenue – COGS×100

This indicates how much is added to the cost to arrive at the selling price.

This distinction becomes particularly important in warehouse and logistics operations, where pricing strategies must balance competitiveness with profitability across numerous SKUs and service offerings.

The confusion between these metrics can lead to significant financial miscalculations. For example, a logistics manager targeting a 25% profit margin who mistakenly applies a 25% markup will end up with only a 20% margin, potentially missing profit goals.

This discrepancy arises because markup is always mathematically larger than the equivalent margin:

-

A 100% markup (selling at double the cost) results in a 50% margin.

-

A 50% markup corresponds to a 33.3% margin.

Understanding this relationship helps supply chain professionals avoid the common pitfall of setting prices too low when using the wrong calculation method—protecting profitability even when sales volumes look strong.

In practical applications, gross margin typically serves as an internal performance metric that helps management understand how efficiently the business converts sales into profit before accounting for operating expenses. Warehouse operations with high fixed costs might focus intensely on gross margin improvements, knowing that incremental gains directly enhance bottom-line performance due to operational leverage. Markup, meanwhile, functions more as a pricing tool, helping businesses establish selling prices that ensure adequate profitability while remaining competitive in the marketplace. Logistics companies often establish standard markup percentages for different service categories or customer segments based on value perception, competitive landscape, and operational complexity.

The choice between focusing on gross margin or markup depends largely on the specific business context and objectives. For supply chain businesses operating on high volumes with thin margins, such as third-party logistics providers or distribution centers, even slight improvements in gross margin percentages can significantly impact overall profitability. These operations might focus intensely on margin analysis, seeking efficiency improvements or strategic pricing adjustments. Conversely, businesses offering specialized logistics services with significant value-add components might concentrate more on markup strategies, ensuring their pricing adequately reflects the premium nature of their offerings while maintaining market competitiveness. The most successful supply chain organizations maintain awareness of both metrics, using them in complementary ways to optimize their financial performance across diverse product and service portfolios.

The Role of Operating Profit Margin in Business Analysis

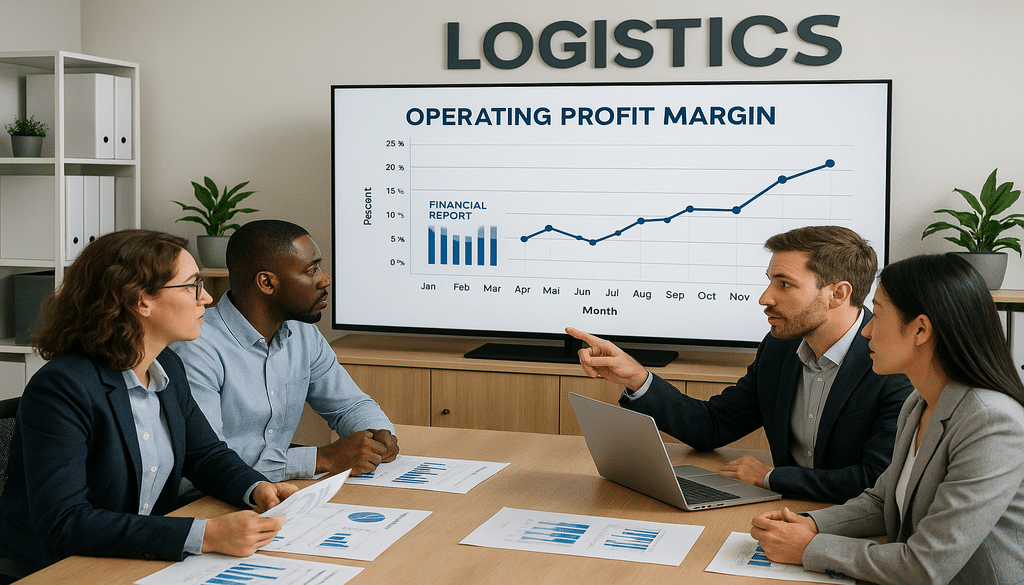

Operating profit margin extends the financial analysis beyond gross margin by incorporating the operational expenses required to run the business, providing a more comprehensive view of profitability. This metric is calculated by dividing operating income (revenue minus COGS and operating expenses) by revenue, expressed as a percentage. For warehouse and logistics operations, operating profit margin captures the impact of critical expenses such as facility costs, equipment maintenance, administrative salaries, and transportation expenditures that aren’t included in gross margin calculations. This broader perspective makes operating profit margin an essential indicator of operational efficiency and management effectiveness, revealing how well a business controls its overhead costs while delivering products or services to customers.

The distinction between gross profit margin and operating profit margin becomes particularly significant in logistics and supply chain businesses, where operational costs often represent a substantial portion of total expenses. A distribution center might achieve an impressive gross margin by negotiating favorable supplier terms, only to see those gains diminished by inefficient warehouse operations that drive up operating costs. By analyzing operating profit margin alongside gross margin, management can identify whether profitability challenges stem from direct costs (reflected in gross margin) or operational inefficiencies (revealed in the gap between gross and operating margins). This layered analysis helps prioritize improvement initiatives, directing resources toward addressing the most impactful areas of the business.

Operating profit margin serves as a crucial metric for financial analysis and decision-making across various business contexts. When evaluating potential expansion opportunities, such as adding new warehouse facilities or entering new markets, projected operating profit margins help assess the financial viability of these initiatives beyond the direct cost considerations. Similarly, when comparing performance across different business units or locations within a logistics network, operating profit margin provides a more equitable basis for evaluation than gross margin alone, as it accounts for variations in operational requirements and overhead structures. This comprehensive view supports more informed strategic planning and resource allocation decisions throughout the organization.

Furthermore, operating profit margin trends over time offer valuable insights into a business’s financial trajectory and competitive positioning. A declining operating margin despite stable or improving gross margins might signal escalating overhead costs or pricing pressures that require management attention. Conversely, an improving operating margin in a challenging market environment demonstrates effective cost control and operational excellence that can create sustainable competitive advantages. For warehouse and logistics professionals, monitoring these trends enables proactive management interventions before financial challenges become critical, supporting long-term business stability and growth. Additionally, when communicating with stakeholders such as investors or lenders, operating profit margin provides a more accurate representation of business performance than revenue growth or gross margin alone, facilitating more productive financial discussions and relationships.

Best Practices for Monitoring and Improving Profit Margins

Implementing a systematic approach to margin monitoring creates a foundation for sustainable financial improvement in warehouse and logistics operations. Begin by establishing a regular cadence for margin analysis—weekly for high-velocity product lines and monthly for overall business performance—using consistent calculation methodologies to ensure valid comparisons over time. Develop dashboards that visualize margin trends across different dimensions such as product categories, customer segments, and sales channels, making patterns and anomalies immediately apparent to management. Set specific margin targets based on industry benchmarks and company objectives, then track performance against these goals with clear accountability for results. This structured monitoring process transforms margin management from a reactive exercise into a proactive discipline that drives continuous financial improvement throughout the organization.

Improving gross margins requires a multifaceted approach that addresses both revenue enhancement and cost management strategies. On the revenue side, consider implementing value-based pricing models that align product or service pricing with the specific benefits customers receive rather than relying on cost-plus formulas that might undervalue your offerings. Regularly analyze product mix to identify high-margin items that deserve additional marketing support or sales incentives to increase their proportion of overall revenue. For cost management, leverage volume purchasing discounts by consolidating orders where possible, and negotiate improved supplier terms based on projected growth or long-term commitments. In warehouse operations, focus on reducing handling costs through layout optimization and process streamlining, while also minimizing inventory carrying costs through improved forecasting and just-in-time inventory management techniques.

Technology plays an increasingly critical role in margin analysis and enhancement across the supply chain sector. Advanced inventory management systems provide real-time visibility into product costs and performance, enabling more informed pricing and purchasing decisions. Predictive analytics tools help identify margin erosion before it significantly impacts financial results, allowing for preemptive corrective actions. Automated pricing systems can adjust product prices based on demand patterns, competitor actions, and cost changes, maintaining optimal margins without manual intervention. For logistics operations, route optimization software minimizes transportation costs while meeting service requirements, directly improving margins on delivery services. These technological solutions, when integrated with financial systems, create a powerful ecosystem for margin management that combines data accuracy with analytical sophistication.

Building a margin-focused organizational culture represents perhaps the most sustainable approach to long-term profit improvement. This cultural shift begins with education—ensuring that employees throughout the organization understand how their daily decisions impact margins and why margin management matters to business success. Incorporate margin metrics into performance evaluations and incentive structures, particularly for roles with direct influence over pricing, purchasing, or operational efficiency. Celebrate margin wins publicly, sharing success stories where teams identified and implemented margin improvement initiatives. Create cross-functional margin improvement teams that bring together perspectives from sales, operations, procurement, and finance to develop comprehensive strategies rather than siloed approaches. By embedding margin awareness throughout the organization, warehouse and logistics businesses create a sustainable competitive advantage that transcends individual improvement initiatives and becomes part of their operational DNA.

Conclusion

Throughout this comprehensive guide, we’ve explored the essential components of profit margin calculation and how utilizing a dedicated margin calculator can transform financial analysis from a complex exercise into a strategic advantage. By understanding the fundamental differences between gross margin and markup, supply chain and logistics professionals can avoid common calculation errors that might otherwise lead to pricing mistakes and missed profit targets. The inclusion of operating profit margin in your financial analysis toolkit provides a more complete picture of business performance, accounting for the operational realities that directly impact bottom-line results.

Effective margin management represents one of the most powerful levers available to warehouse and logistics leaders seeking to improve financial performance. By implementing the monitoring practices, improvement strategies, and technological solutions outlined in this guide, businesses can identify margin enhancement opportunities that might otherwise remain hidden within aggregate financial reports. These incremental improvements, when compounded across multiple product lines and service offerings, can dramatically impact overall profitability without requiring significant additional investment or market expansion.

As the supply chain and logistics industry continues to face challenges including cost pressures, customer expectations for competitive pricing, and global market uncertainties, the ability to accurately calculate, monitor, and improve profit margins becomes increasingly crucial for business sustainability. We encourage you to implement the approaches discussed in this guide, adapting them to your specific business context while maintaining a disciplined focus on margin management as a core component of your financial strategy. By doing so, you’ll position your organization for continued success regardless of market conditions, building resilience through financial clarity and strategic pricing excellence.

Frequently Asked Questions (FAQ)

Q1: What is the most accurate way to calculate profit margin using a margin calculator?

To ensure accuracy when using a margin calculator, input precise cost and revenue figures. Start by determining your total cost of goods sold (COGS), including all direct costs such as materials, labor, and shipping expenses related to your products or services. Then calculate your total revenue from sales during the same period. Input these figures into the calculator to get the gross profit margin percentage. For markup calculation, divide the gross profit by the COGS and multiply by 100 to express it as a percentage. Always double-check your inputs for any possible errors to ensure the calculator provides reliable output. Consider breaking down calculations by product line or service category for more granular insights into where your business generates the highest margins.

Q2: How often should I review my business’s profit margins?

Regular review of your business’s profit margins is crucial for maintaining financial health. Ideally, profit margins should be assessed quarterly to align with financial reporting, but monthly reviews can be beneficial for more dynamic adjustments, especially in volatile markets or during periods of significant cost changes. This frequent analysis helps in identifying trends, addressing inefficiencies, and adapting strategies to market changes, ensuring sustained profitability. Different levels of margin analysis may require different frequencies – daily or weekly monitoring might be appropriate for high-volume product lines or during promotional periods, while comprehensive margin reviews including all operating expenses might be conducted quarterly or monthly. The key is establishing a consistent review schedule that provides timely insights without creating unnecessary administrative burden.